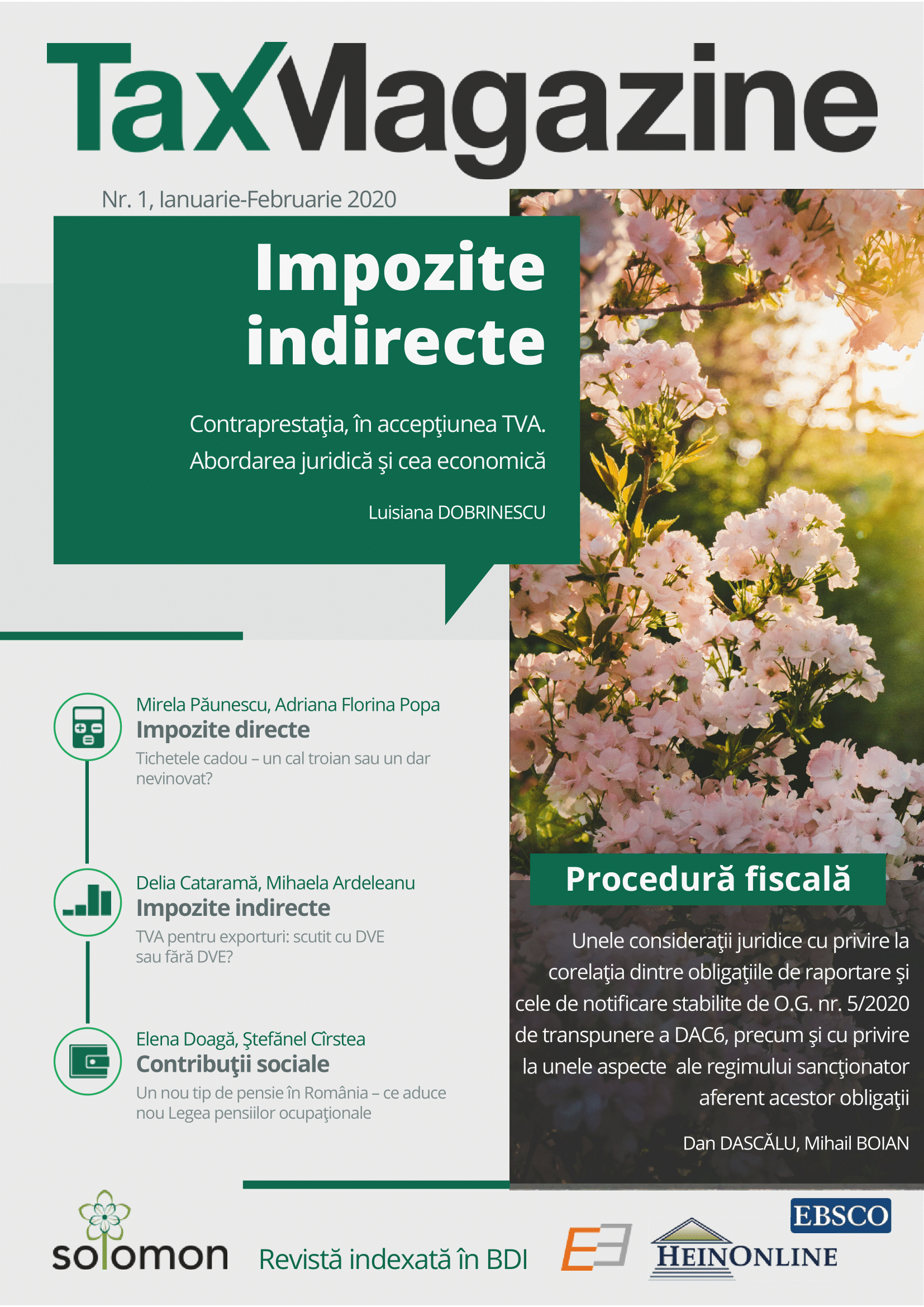

TVA pentru exporturi: scutit cu DVE sau fără DVE?

VAT for exports: exempt with or without Export

Declaration?

Author(s): Delia Cataramă, Mihaela ArdeleanuSubject(s): Civil Law, EU-Legislation, Commercial Law

Published by: Editura Solomon

Keywords: VAT; VAT for exports; Export Declaration;

Summary/Abstract: In the daily activity we often encounter the approach of the Romanian tax authority according to which the supplier can apply the VAT exemption only if he is in possession of the customs documents from which he states that he has the status of exporter. The recent jurisprudence of the European Court of Justice calls into question this formalist approach. Therefore, through this article we intend to draw attention to the problems arising from the formalist approach of the tax authorities in Romania, an approach contradictory to that of the European Court of Justice, which ruled the prevalence of substantive conditions in detriment to those of form. Thus, in the first section we will analyze the principles and rules established by Directive 2006/112/EC on the common VAT system (hereinafter referred to as the “VAT Directive”) in respect with exemption from export operations, in the second section we will present how these rules were adopted in the national legislation while in the third section we will tackle the main problems encountered in practice regarding the application of the exemption for exports and we will propose a series of solutions to manage them.

Journal: Tax Magazine

- Issue Year: 2020

- Issue No: 1

- Page Range: 31-37

- Page Count: 7

- Language: Romanian

- Content File-PDF