Implicații fiscale aferente investițiilor – achiziție de acțiuni

sau achiziție de active?

Tax implications related to investment – share deal or asset deal?

Author(s): Dragoş Nicolae, Madalina Ticu, Andreea IgnătescuSubject(s): Commercial Law

Published by: Editura Solomon

Keywords: Tax implications; investment;

Summary/Abstract: The Mergers and Acquisitions market in Romania has registered remarkable growth in recent years. Romania is an increasingly attractive market for both strategic investors and investment funds. This is mainly due to the strategic position in Central and Eastern Europe (CEE), Romania has the second largest population among the countries in the CEE region and has had the fastest rate of economic growth since 2016. At the same time, the relatively low level of taxation, competitive wages and the significant market consolidation opportunities in dynamic industries play an important role in attracting investment. In this favourable context, we expect the trend of transactions on the Romanian Mergers and Acquisitions market to continue upward in 2020. Acquiring a company registered in Romania involves a complex preliminary analysis from financial, tax, legal, environmental, commercial and technical points of view. This analysis represents an important step before making the decision to invest, because it enables the risks and benefits of the transaction to be identified and the correct purchase price to be established. The analysis will also help to identify any contractual clauses which may need to be negotiated as well as to establish appropriate measures which may need to be taken to protect against potential future risks. The analysis should be closely correlated with the way in which the investment is planned to be made – i.e. whether it will involve acquisition of the shares in the company that is the subject of the transaction (a „share deal”), or the acquisition of assets held by the target company (an „asset deal”). Thus, depending on the industry in which the company operates and its assets, both parties involved (Seller and Buyer), will need to carefully consider the optimal option to complete the transaction. In the following, we will briefly present the characteristics of each of the two alternatives as well as the relevant tax implications.

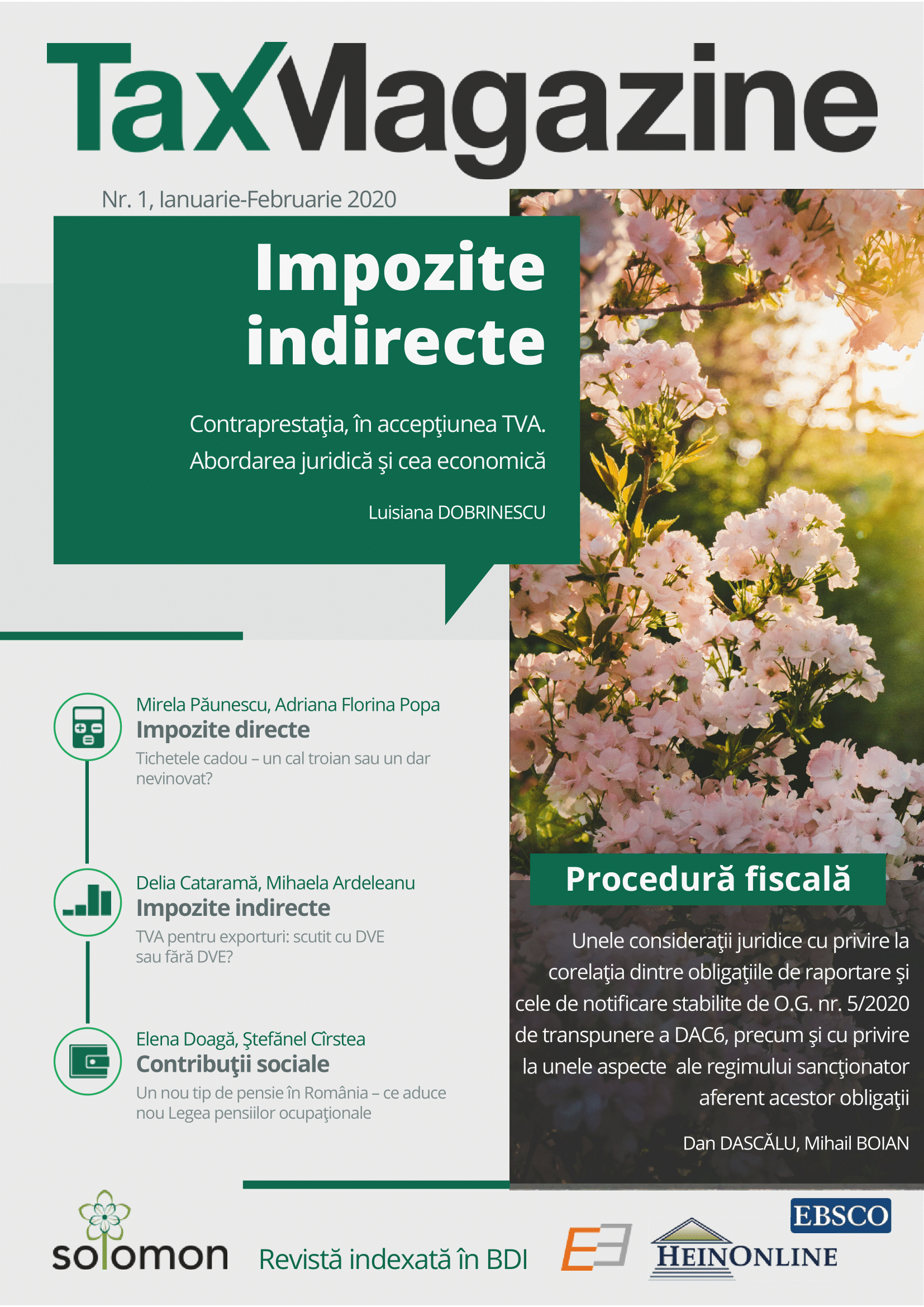

Journal: Tax Magazine

- Issue Year: 2020

- Issue No: 1

- Page Range: 9-14

- Page Count: 6

- Language: Romanian

- Content File-PDF