The Pillar One Deal: Implications for Countries and Taxpayers

The Pillar One Deal: Implications for Countries and Taxpayers

Author(s): Ruth MirembeSubject(s): Supranational / Global Economy, Economic policy, International relations/trade, Fiscal Politics / Budgeting

Published by: Szkoła Główna Handlowa w Warszawie

Keywords: OECD Pillar One; participation in Pillar One negotiation; Pillar One gains and losses; complexity;

Summary/Abstract: After years of trying to find multilateral solutions to the challenges brought about by the digitalisation of the economy, the OECD Inclusive Framework tabled the OECD Pillar One proposal in 2019. The Pillar One proposal reallocates taxing rights to market jurisdictions based on a standard formula. The proposal is a deal borne out of negotiation by countries, with input from international organisations and multinational enterprises. Like any deal, there are gains and losses – but only in this case, the impact spills over to parties that are not part of the deal such as taxpayers. In this article, the author discusses the Pillar One deal, looking at the potential benefits and losses for countries and taxpayers.

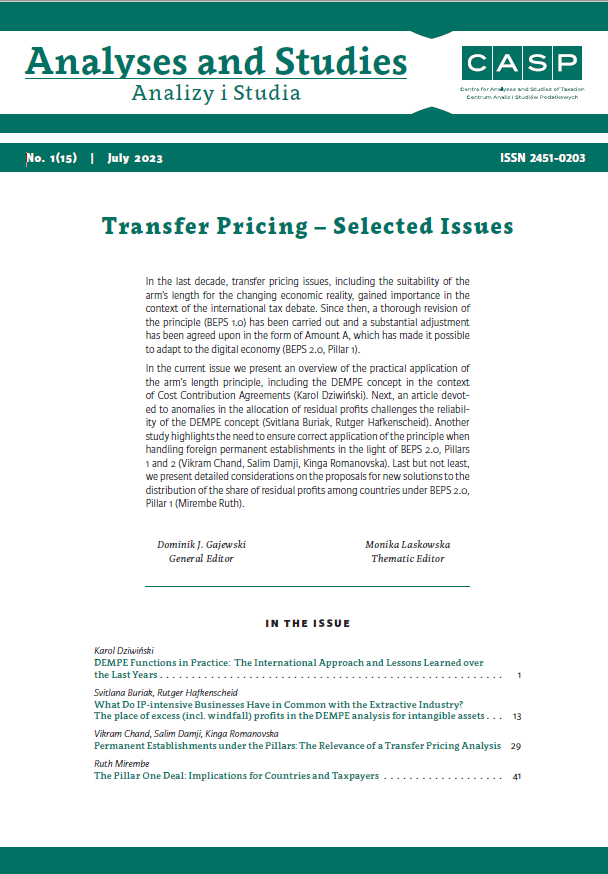

Journal: Analizy i Studia CASP

- Issue Year: 15/2023

- Issue No: 1

- Page Range: 43-56

- Page Count: 14

- Language: English