Permanent Establishments under the Pillars: The Relevance of a Transfer Pricing Analysis

Permanent Establishments under the Pillars: The Relevance of a Transfer Pricing Analysis

Author(s): Vikram Chand, Salim Damji, Kinga RomanovskaSubject(s): Business Economy / Management, Economic policy, Commercial Law

Published by: Szkoła Główna Handlowa w Warszawie

Keywords: transfer pricing; pillar one; pillar two; permanent establishment;

Summary/Abstract: This paper analyses the treatment of Permanent Establishments (PEs) under the OECD’s Pillar One and Pillar Two frameworks. It delves into the complexities of the Global Anti Base Erosion Model Rules (GloBE) and the Qualified Domestic Minimum Top-Up Tax (QDMTT) rules under Pillar Two, as well as the reallocation of taxing rights under Pillar One. The role of transfer pricing in dealing with PEs is scrutinised, particularly its influence on the calculation of Adjusted GloBE income and Elimination Profit. The practical implications of these rules on PEs are illustrated through case studies. The paper also highlights the potential for disputes and the need for upfront certainty on transfer pricing positions.

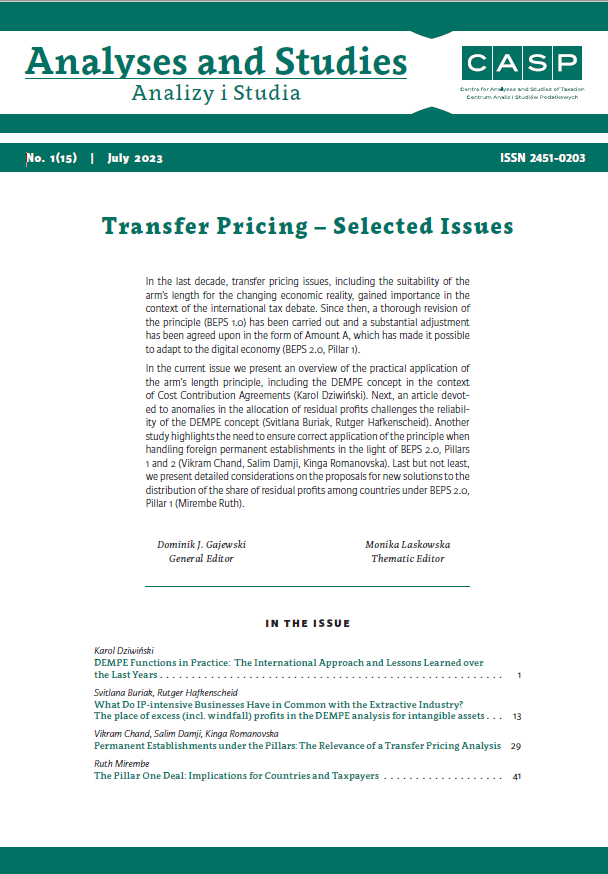

Journal: Analizy i Studia CASP

- Issue Year: 15/2023

- Issue No: 1

- Page Range: 31-42

- Page Count: 12

- Language: English