What Do IP-intensive Businesses Have in Common with the Extractive Industry?

What Do IP-intensive Businesses Have in Common with the Extractive Industry?

Author(s): Svitlana Buriak, Rutger HafkenscheidSubject(s): Business Economy / Management, Civil Law, Public Law, International relations/trade

Published by: Szkoła Główna Handlowa w Warszawie

Keywords: windfall profit; economic crisis; transfer pricing; economic rent; residual profit; intellectual property; DEMPE; value creation; value capture; International taxation; income allocation;

Summary/Abstract: In this article, we touch upon one of the most topical and debatable loopholes in transfer pricing: how market distortions, dominant market power, and economic conditions that do not fit the normal economic cycle should affect transfer pricing analysis of controlled transactions. During the most recent economic crises triggered by the COVID-19 pandemic and the energy security crisis as consequences of the Russian invasion of Ukraine, it became clear that business profits may not always be a direct result of investors’ decisions, or in transfer pricing terms – of functions performed, assets used, or risks assumed, but, instead, a consequence of external circumstances. Such external circumstances may include rapid distortions in the supply and demand equilibrium for certain goods or services, such as digital software or energy resources. Yet, some external factors are not connected to a stage of the economic cycle, among which there are the market power or distorted competition, i.e. oligopoly, monopoly, or a monopsony position in the market. In this article we observe that the ability of some sectors of the economy to capture abnormal returns is not a matter of luck or unpredictable events only. Instead, the ownership of certain scarce resources or artificially scarce assets determines the ability to generate excess (residual) returns. We build a parallel between the natural resources that produce economic rents and intellectual property assets, the scarcity of which is enabled by the strong system of legal protection of IP rights (in particular, patents) to demonstrate their common characteristic as rent-generating assets. We once again challenge the validity of the concept of value creation, arguing that it does not account for the level of competition, market power, and control and scarcity in the market, which are the main preconditions for a company to generate high profits. Finally, we challenge the mainstream concept of DEMPE for the allocation of profits from intangibles for the fact that it attributes too much value to the stage of development of intangibles. Based on the understanding that IP protection may induce artificial scarcity of IP protected products in the market, which distorts competition and enables the IP owner to receive higher returns, the market jurisdiction should be entitled to a share of the residual profit for the facilitation of the IP protection regime.

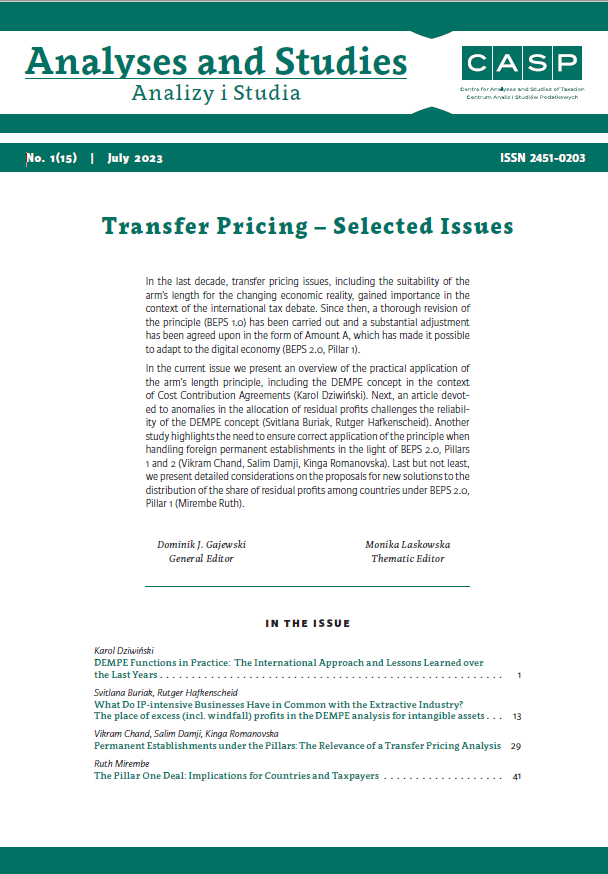

Journal: Analizy i Studia CASP

- Issue Year: 15/2023

- Issue No: 1

- Page Range: 13-30

- Page Count: 18

- Language: English