Distribuirea de dividende cu menținerea adecvării capitalului – soluții în vremuri de incertitudini fiscale

Distribution of dividends under capital adequacy constraints – solutions for tax uncertainty times

Author(s): Romana Schuster, Lucia GrecuSubject(s): Fiscal Politics / Budgeting, Accounting - Business Administration

Published by: Editura Solomon

Keywords: dividends; G.O. 16/2022; accounting; tax; legal implications;

Summary/Abstract: The increase in the dividend tax rate as from January 2023 is not news anymore, but companies’ directors are under pressure to make a few quick decisions before the end of 2022. The decisions they need to take should further the interests of shareholders while preserving companies’ financial health. We analyse here the main accounting, tax, and legal implications of interim distributions of dividends, with a focus on the provisions of G.O. 16/2022 and the draft law to approve this ordinance. We also point out the key points which company directors should consider before making the decision to distribute retained earnings as dividends.

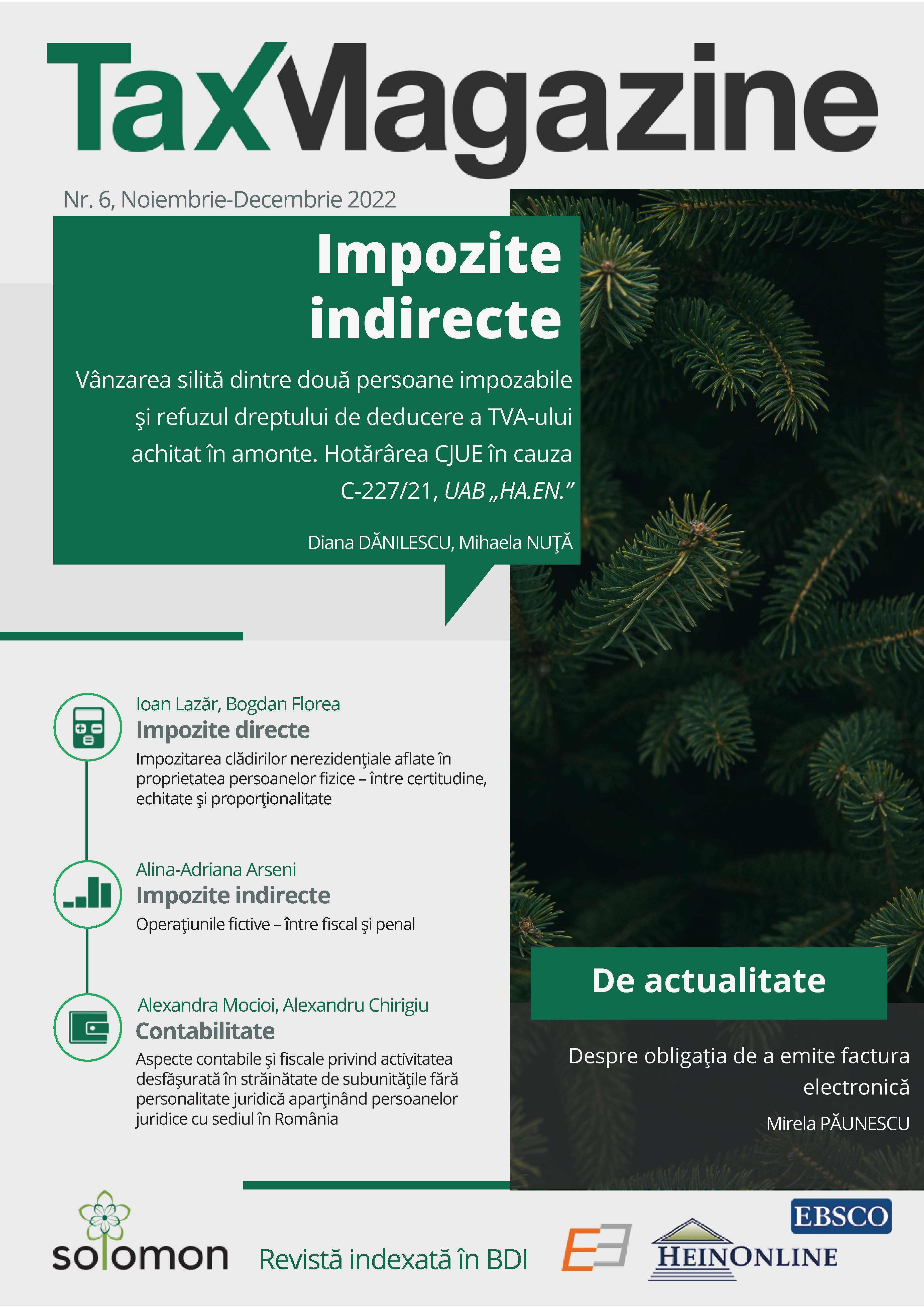

Journal: Tax Magazine

- Issue Year: 2022

- Issue No: 6

- Page Range: 417-420

- Page Count: 4

- Language: Romanian

- Content File-PDF