SOCIO-DEMOGRAPHIC VARIABLES FORMING A ERCEPTION OF CORPORATE IMAGE BRAND IN THE CROATIAN BANKING INDUSTRY

SOCIO-DEMOGRAPHIC VARIABLES FORMING A ERCEPTION OF CORPORATE IMAGE BRAND IN THE CROATIAN BANKING INDUSTRY

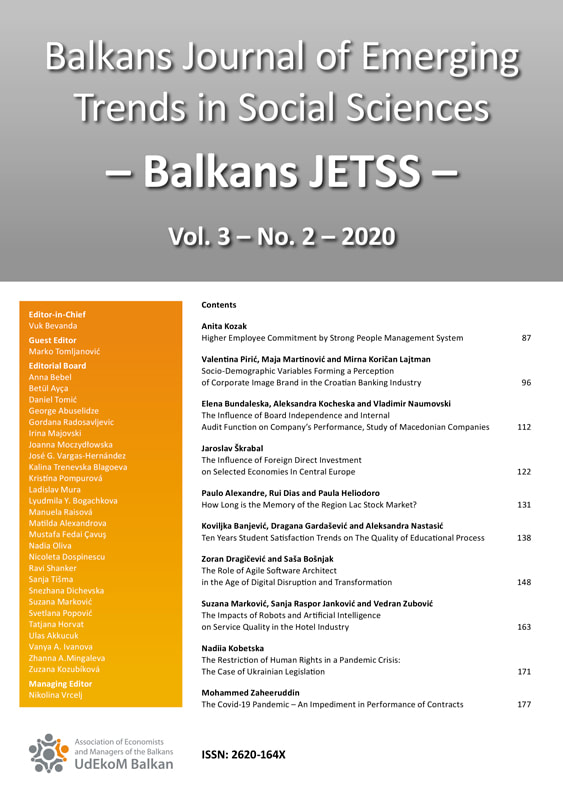

Author(s): Valentina Pirić, Maja Martinović, Mirna Koričan LajtmanSubject(s): Business Economy / Management, Financial Markets, Marketing / Advertising

Published by: Udruženje ekonomista i menadžera Balkana

Keywords: Corporate image;Consumer choice;Corporate branding;Corporate identity;Croatian banking industry

Summary/Abstract: The banking industry is currently at the forefront of the development of technology-based service delivery, and the survival of banks depends on their ability to deal with the environmental challenges. Due to these challenges, many banks are faced with an identity crisis and increased customer migration rates that negatively affect the levels of business profitability. Croatian market ads additionally challenge almost 30 banks currently operating with customers that are extremely price sensitive. Research shows that in the banking sector, a favorable image is considered a critical aspect of a company’s ability to maintain its market position, as the image has been related to core attributes of organizational success. This paper studies the dimensions of corporate image, focusing on the corporate image concept in the Croatian banking industry as perceived by consumers and its possible impact on their choice of banks. The purpose of this study is to give an insight and provide a deeper understanding of how the banks, by developing a strong and consistent corporate image using corporate communication activities, ensure a long-term source of sustainable competitive advantage and influence on customers’ end choice. A study was carried out in Croatia during 2019 using 250 respondents-consumers who used different types of banking services in different banks. Series of ANOVA analysis shows how the perception of the corporate image of the bank and its influence on the customer’s choice of the bank, bank loyalty and the quality of the bank services varies depending on some demographic and social variables. Results pose implications for bank communications and service positioning within customer segments. This research raises ideas for future studies as well.

Journal: Balkans Journal of Emerging Trends in Social Sciences Balkans JETSS

- Issue Year: 3/2020

- Issue No: 2

- Page Range: 96-111

- Page Count: 16

- Language: English