The Remuneration of Teachers and Researchers under Art. 21 of the Brazil-Poland Double Taxation Convention of 2022 in the Light of the Polish Treaty Practice

The Remuneration of Teachers and Researchers under Art. 21 of the Brazil-Poland Double Taxation Convention of 2022 in the Light of the Polish Treaty Practice

Author(s): Małgorzata SękSubject(s): Law, Constitution, Jurisprudence

Published by: Wydawnictwo Uniwersytetu Łódzkiego

Keywords: teachers; researchers; double taxation; double non-taxation; exemption; tax treaty; double taxation convention; Poland; Brazil

Summary/Abstract: The aim of this paper is to analyze an exemption addressed to visiting teachers and researchers included in Art. 21 of the Agreement between the Republic of Poland and the Federative Republic of Brazil for the elimination of double taxation with respect to taxes on income and the prevention of tax evasion and avoidance signed in New York on 20 September 2022. The Brazil-Poland provision is compared with its equivalents included in agreements concluded by Poland with other countries. Clauses limiting or extending the application of the exemption, present or missing in Art. 21 of the Brazil-Poland DTC, are discussed. The said provision is also assessed against content and/or quality criteria that such a special provision should fulfill.

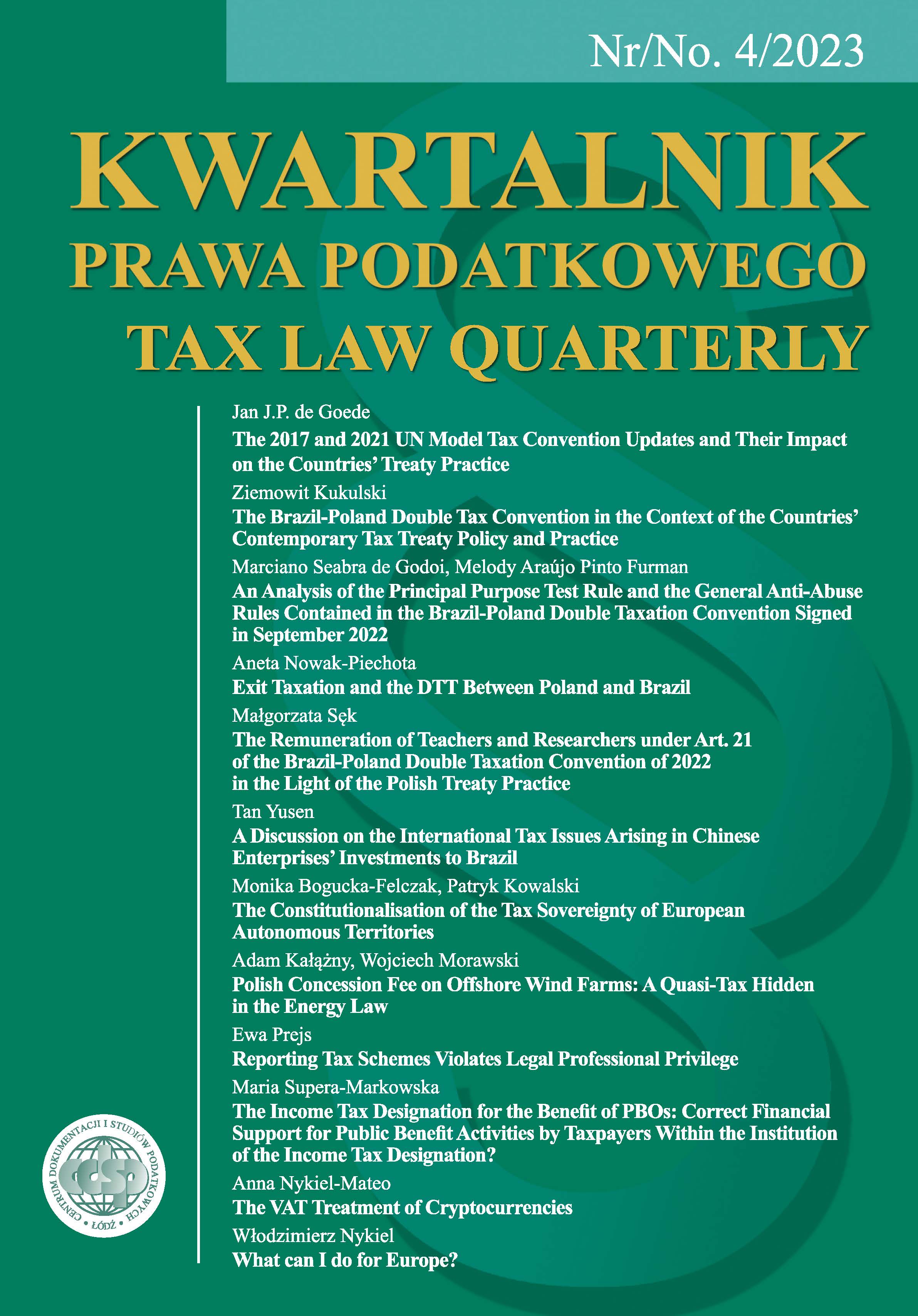

Journal: Kwartalnik Prawa Podatkowego

- Issue Year: 2023

- Issue No: 4

- Page Range: 87-103

- Page Count: 17

- Language: English