The 2017 and 2021 UN Model Tax Convention Updates and Their Impact on the Countries’ Treaty Practice

The 2017 and 2021 UN Model Tax Convention Updates and Their Impact on the Countries’ Treaty Practice

Author(s): Jan J.P. de GoedeSubject(s): Law, Constitution, Jurisprudence

Published by: Wydawnictwo Uniwersytetu Łódzkiego

Keywords: UN Model Double Taxation Convention between Developed and Developing Countries; fees for technical services; income from automated digital services; tax treaty policy

Summary/Abstract: This paper deals with the 2017 and 2021 UN Model updates and their possible impact on countries’ tax treaty policy and practice. The Author provides an overview of the most relevant changes to the text of the UN Models 2017 and 2021, and possible interactions between the two most important new UN Model’s provisions: Article 12A dealing with fees for technical services and Article 12B dealing with income from automated digital services and Pilar One and Pilar Two.

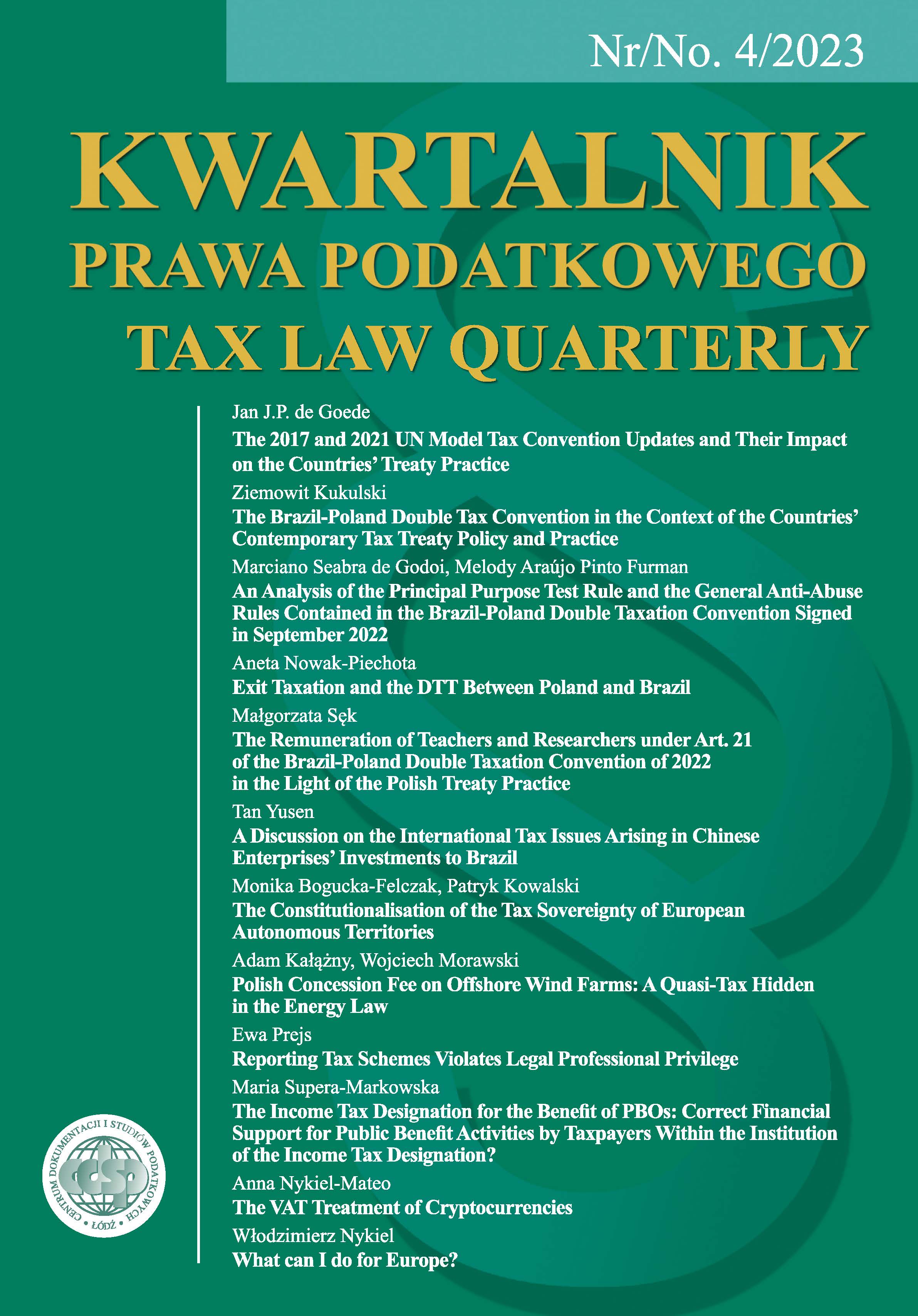

Journal: Kwartalnik Prawa Podatkowego

- Issue Year: 2023

- Issue No: 4

- Page Range: 9-29

- Page Count: 21

- Language: English