„Automatyzm” działania organów podatkowych przy wydawaniu decyzji zabezpieczających w związku z zakwestionowaniem prawa do odliczenia podatku naliczonego na podstawie tzw. pustych faktur

Issuance of a decision to establish security in relation with a denial of the right to deduct input tax on the basis of fictious invoices

Author(s): Dariusz GibasiewiczSubject(s): Law, Constitution, Jurisprudence

Published by: Wydawnictwo Uniwersytetu Łódzkiego

Keywords: decision to establish security; reasonable expectation that a tax liability will not be performed; input tax deduction; fictious invoices; principle of trust in tax authorities

Summary/Abstract: The article deals with the issuance by tax authorities of decisions securing the execution of a tax liability on the taxpayer’s property prior to the issuance of a decision determining the amount of liability in value added tax in connection with tax proceedings, tax inspection, or customs and tax inspection, which are carried out in relation to questioning by the tax authorities the deduction of input tax on the basis of fictious invoices. It presents how these regulations are interpreted and applied by tax authorities and administrative courts in specific cases. It also analyzes the mistakes made in such proceedings and violations of the taxpayer’s rights. At the same time, the correct model of handling and adjudication in this type of cases with respect for the rights of taxpayers is presented.

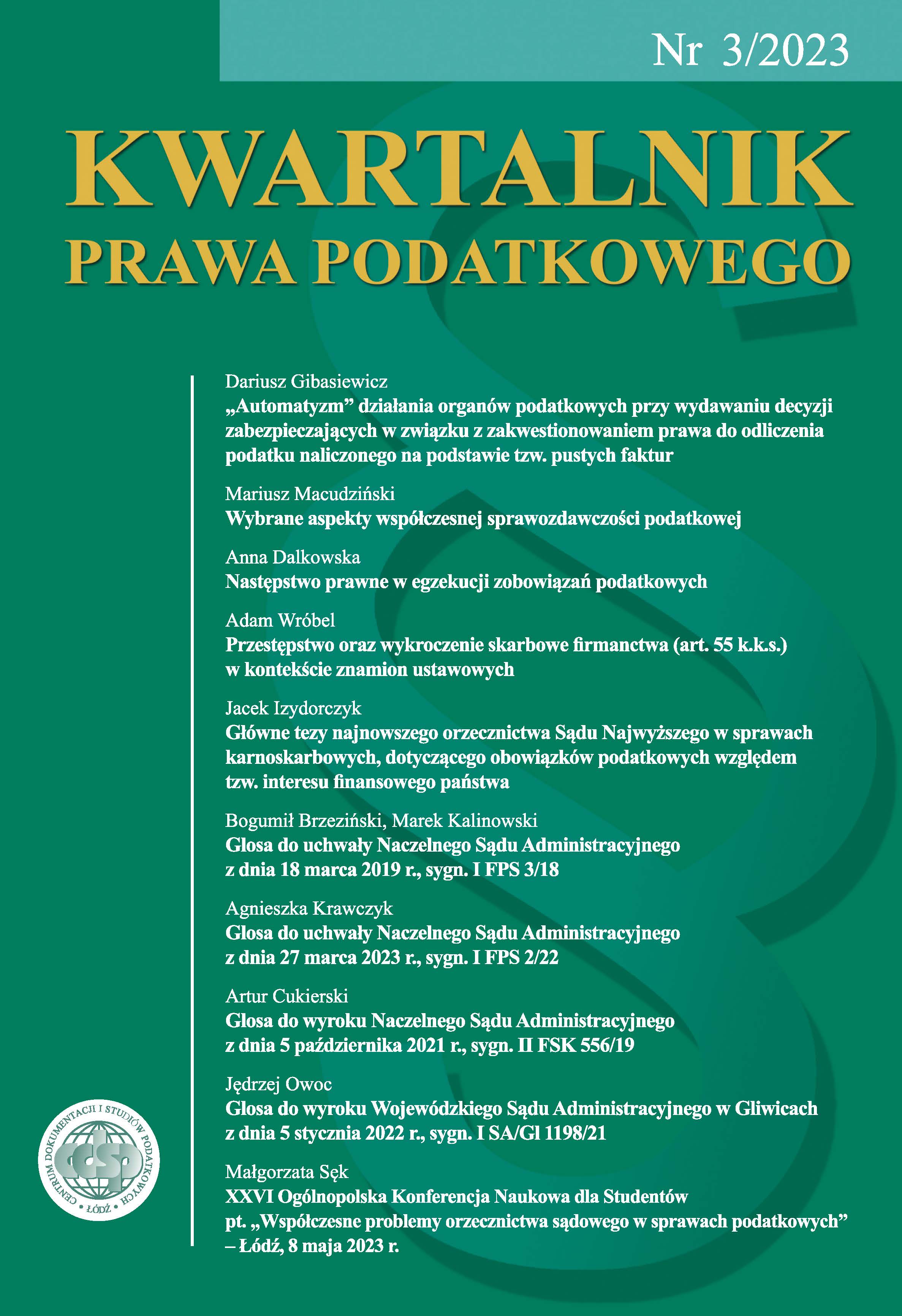

Journal: Kwartalnik Prawa Podatkowego

- Issue Year: 2023

- Issue No: 3

- Page Range: 9-36

- Page Count: 28

- Language: Polish