DETERMINANTS OF STOCK MARKET LIQUIDITY. THE QUANTIFIABLE EFFECTS OF PSYCHIC DISTANCE STIMULI

DETERMINANTS OF STOCK MARKET LIQUIDITY. THE QUANTIFIABLE EFFECTS OF PSYCHIC DISTANCE STIMULI

Author(s): Andrei DimceaSubject(s): Business Economy / Management, Financial Markets

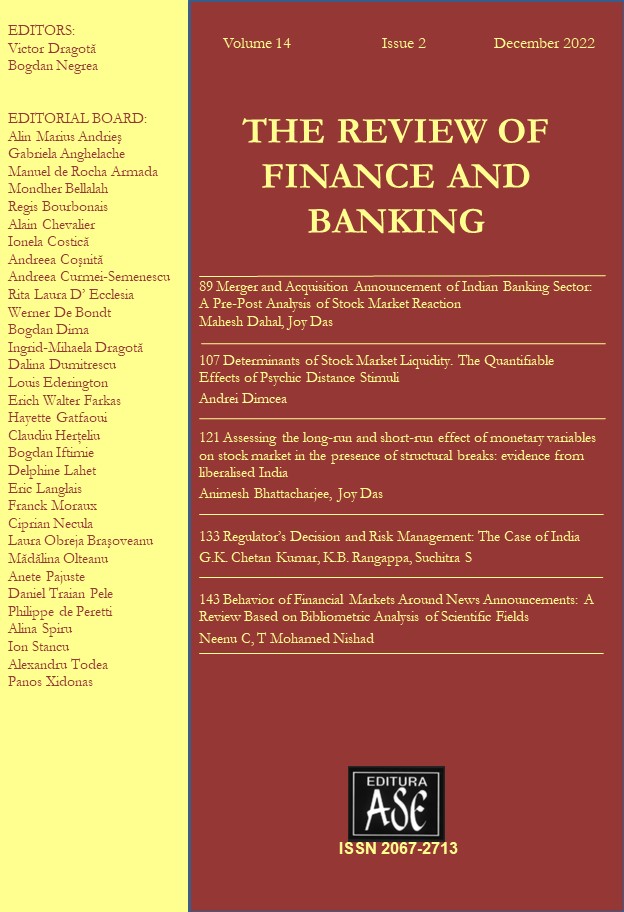

Published by: EDITURA ASE

Keywords: Psychic distance; liquidity; culture; panel regression;

Summary/Abstract: Our study aims to narrow the existing gap in the academic literature on cultural determinants of stock market liquidity by addressing the problem through a completely new lens - that of the international investor’s point of view. To do this, we resort to bringing together the financial and psychological concepts and use a proxy that can measure the perception an individual investor has upon the differences between his/her home country and other countries. The motivation behind this decision is as follows: despite there being a waste majority of studies analyzing the cross-country cultural distance effects upon the stock market liquidity, they only resume to describing those effects through the perspective of the domestic investor. We decided to go one step further and employ a proxy to capture the effects of the difference between the home country and the target country upon an investor’s decisions to trade internationally, which in turn, can affect the overall liquidity of the stock market in the target country. This proxy is called psychic distance stimuli and was first measured and used by Douglas Dow. We performed the analysis on a rather extensive sample of 21 developed and 24 developing countries, spanning an interval of 21 years, beginning in 1996. The results confirm our hypothesis that the measure of psychic distance plays a significant role in explaining the liquidity of the stock market in the target country.

Journal: The Review of Finance and Banking

- Issue Year: 14/2022

- Issue No: 2

- Page Range: 107-120

- Page Count: 14

- Language: English